On the day of this writing, one U.S. dollar is roughly equally to one Swiss franc.

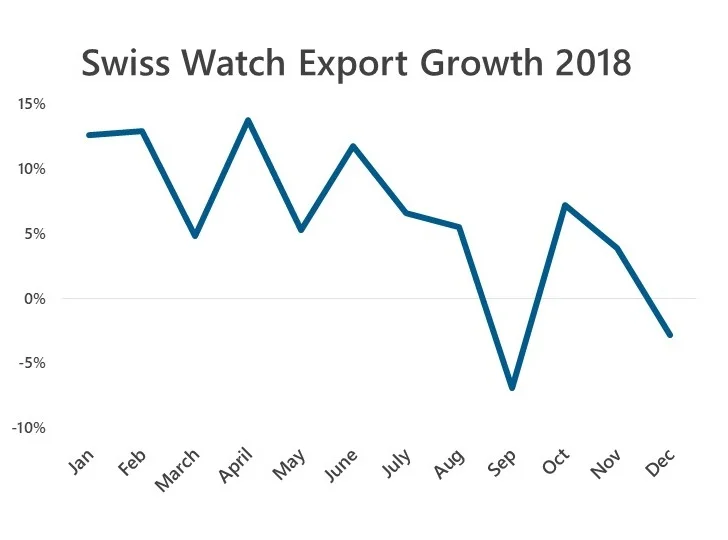

Swiss watch exports fell 2.8% in December, the second monthly fall in the year, following a decline in September. In December, exports totaled 1.6 billion francs, bringing the final export total in 2018 to 21.2 billion francs, an increase of 6.3% over 2017. Overall, exports are up for the second consecutive year, but still short of the high-water mark set in 2015.

Continuing a trend we reported in December, bimetal (gold-steel) watches recorded another increase in December, growing 3.1% year-over-year. The total number of items (watches) exported fell by 10% for the third consecutive month, as high-priced watches remained the only source of growth and stability in the industry.

Above 500 francs, export turnover was stable, with the 500-3,000 francs and 3,000+ francs categories reporting stable growth, and the 3,000+ francs category even seeing an increase in units sold. The 200-500 francs category was hit the hardest, seeing a 20% decline in sales year-over-year.

The drop in sales at the low end of the market is a sustained trend. | FHH

Half of the 30 most largest markets grew in December, led by growth in the second-largest market, the United States, of 7.9%. But, a slow down in the third-largest market, China, dragged down other bright spots: Exports to China were down 10.1% (effect of trade wars?). Europe too saw slowing growth — as a region it was down 5.8% — the decline in France (-11.6%), Italy (-14.6%), and Spain (-10.1%) were particularly pronounced.

A Strong 2018, with Signs of Stagnation

In total, Swiss watch exports were up 6.3% in 2018, totaling 21.2 billion francs. Growth rates varied widely across the world, with European exports totaling 185.7 million francs, down 5.8% from the previous year. This reflects a slowdown in the second half of the year though, as sales were up 10% from January to June.

Asian exports were up 12.2% on the year, while American exports were up 7.2%. Though comparing to a small number, exports to Oceania were up a staggering 18.7% on the year, with total exports to the region totaling more than European exports at 257.5 million francs.

Four of the five, and eight of the ten largest individual country markets also saw growth on the year, with only European countries providing a stain on the generally strong market in the watch industry’s most important regions. As is typical, Hong Kong was the most important watch market in the world, with exports totaling 3 billion francs, and still-phenomenal growth of 19.1%. As a recognition of this importance, an increasing number of important watch auctions are held in Japan. Brands have long played to the market by creating Hong Kong-specific limited edition timepieces.

Growth overall slowed in the second half of 2018, reflecting more secular worries that spread throughout the global economy.

Head to the Federation of the Swiss Watch Industry’s website for the full report.