Shares of luxury goods group Richemont closed higher on Friday as it announced strong sales growth amid weaker profitability in its 2019 fiscal year, which ended March 31.

Last year, Richemont purchased online pre-owned watch retailer Watchfinder, as well as online luxury destination Yoox Net-a-Porter. It also recently announced a joint venture with ecommerce giant Alibaba, though it continued to provide few details on that arrangement on its earnings call. With the acquisition of the online retailers, 16% of Richemont’s sales are now online.

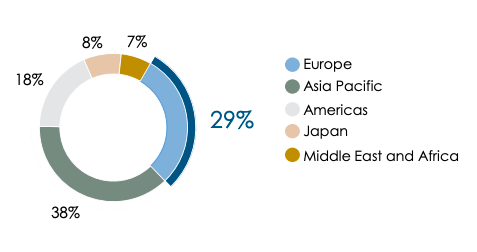

Richemont’s transforming distribution channels

Overall, sales rose 27% — 8% if excluding the recently acquired online retailers. But, earnings climbed just 5% to €1.94 billion in the 12 months ended March 2019. Analysts had expected earnings of €2.05 billion. Richemont’s operating margin slipped to 13.9%, its lowest in more than a decade.

Richemont divides its brands into “jewelry maisons” and “specialty watchmaker”. The watchmakers include A Lange & Sohne, IWC, Jaeger-LeCoultre, Vacheron Constantin, and Panerai. meanwhile, the jewelry maisons, driven by Cartier and Van Cleef & Arpels, continue to be Richemont’s largest, and most profitable, business line. In 2019, jewelry made up 36% of Richemont’s sales, while watches made up 35%.

While jewelry brands reported a strong operating margin of 31.5%, the watchmakers' margin was only 12.7%, though this is an improvement over last year’s 9.7%. Richemont attributed this to mainly to manufacturing efficiencies and cost controls. Total watches sales in 2019 reached €5 billion.

Richemont watch product sales, FY16-FY19

Of the €5 billion of total growth in watch sales, €3 billion came from the speciality watchmakers (because Van Cleef & Arpels and Cartier also sell watches, not all of watch product sales are attrbitued to what Richemont calls its “specialty watchmakers”).

Sales growth of the watchmakers was up 10% overall, just 2% excluding prior year inventory buybacks, with particularly strong growth in Japan, the rest of Asia, and the Americas. Richemont said that most of its watch maisons experienced retail growth, with Jaeger-LeCoultre,Vacheron Constantin, and IWC being particularly noteworthy. Collectively, the watch brands also opened 11 net new directly operated stores. The watchmakers also experienced online sales growth and a net new number of franchise stores in the retail space.

In a slightly concerning note, Richemont said that Watchfinder has since just single-digit sales growth since the acquisition. Watchfinder sells watches mainly in the pre-owned space (which I generally think of as modern-era watches made in the past 25-30 years), which is a competitive space. But, the assumption had been this was a competitive space because it was lucrative and growing. Watchfinder’s single-digit growth is the first indication I’ve seen that this may not be true.

In Richemont’s largest geographic market, Asia Pacific, it continued to see double-digit growth across Hong Kong and China. Interestingly, sales roles 20% overall in Asia, 14% when excluding the newly acquired online distributors. Meanwhile, the Americas saw 40% total sales growth, but just 11% growth when excluding online distribution.

Richemont acquired Net-a-Porter 11 months ago and Watchfinder 10 months ago, and reported a €264 million loss, attributing most of this loss to one-time amortization expenses realized on purchase.

Richemont shares have climbed 16% so far this year. The stock slumped 29% last year, the worst performance in a decade.

Look, selling online is hard and Richemont is just starting to figure it out. They own the luxury online shopping websites, in Net-a-Porter and Mr. Porter, and that should continue to be a valuable asset. While it seems to have hurt margins in the short term, the websites do allow direct connection with consumers, which in the long term may actually allow for expanded margins, cutting out wholesale distributors and the expensive retail experience that those fancy boutiques attempt to create.

People are just now getting used to buying expensive luxury goods online. Look at Richemont’s “other goods” category — clothes, leather goods, etc. — and you’ll see tremendous growth. And that’s for brands that don’t even specialize in that stuff. People are getting used to buying those types of goods online. Eventually (hopefully, for Richemont’s purposes), they’ll move up to buying jewelry, watches, and other more expensive goods online. At least, that’s Richemont’s long-term bet.

Either way, Richemont needed to make a move into the online space, and the acquisition of Yoox Net-a-Porter was the only way to really make a play. We’ll see if it works.

See Richemont’s earnings report here.